Venturing into male-dominated fields like tech, politics, and finance is generally considered safe for women. But we’re still not out of the woods quite yet. Every year, there are countless reports of career-damaging and annoying encounters with men in the wild. Some simple common-sense tips can help you safely navigate these fields without being eaten alive or called “just a diversity hire.”

Make yourself look bigger and use assertive body language.

Lower every chair other than your own in the conference room before the meeting. Wear pants and sit with your legs apart. Stand with squared shoulders and confidently provide your opinion. Do not back down or break eye contact even if you suspect the CTO knows you have a protein bar in your bag.

Do not feed the men.

They have a natural fear of women, and feeding them lowers these inhibitions. Leave baked goods and birthday treats at home or keep them sealed in an airtight bag in your desk so they don’t come sniffing around.

Stand up and stand out.

It’s a common misconception that as a woman, you should camouflage yourself, keep your head down, and try to go through the male-dominated fields undetected. The men aren’t used to you being there and will lash out if surprised. Warn them of your presence by attaching a bell to your backpack. Clap your hands when rounding corners. They are accustomed to being applauded, and this will put them in a passive state. Announce your presence in a room with something agreeable to men like, “Lambo!” or, “AI is the future!”

Learn to identify tracks and droppings

in the fields so you know what

species you are likely to encounter.

If you find psilocybin microdose gummies, that’s a sure sign a tech founder is around the bend. Tufts of fleece from a vest or a Zyn nicotine pouch? You’re in finance bro territory.

Understand pecking orders.

In certain fields, the men have the advantage of bigger physical size, knowledge of the cultural terrain, and unearned access to natural resources like money, protection of the herd, presumption of higher skill level and rank, and dignity. They have assigned themselves alpha status in the pack by default. You’ll need to be exceptional at your job to earn the same respect as a mediocre man. Remember: you are assumed incompetent prey until proven otherwise.

Speak slowly in nonthreatening, low tones.

Their ears are different. Anything over a horny whisper registers as shrill to the men, and you will be perceived as a threat.

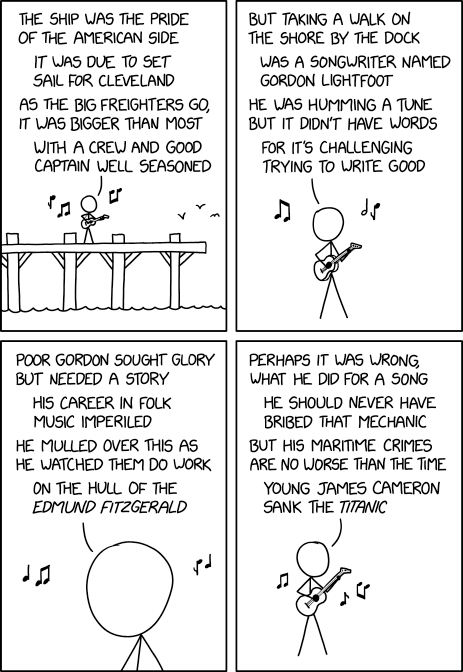

Never assert that any musician

or professional athlete is the “GOAT.”

The men will interpret this as a challenge to spar, and it will put you in the path of a dangerously boring interaction.

Walk. Don’t run.

Getting ahead of a man too fast will trigger a predator-prey reflex, and your promotion will be dismissively explained as “due to high-hanging fruit,” which will be followed by a pause and then, “I’m talking about boobs.” Make calculated, deliberate moves to avoid ruffling feathers. Be sure to back out of meetings slowly, but if the men start discussing cryptocurrency or VR, that’s an emergency, and you will need to get away quickly. Scream, “THE DOW IS DOWN 10 PERCENT!” while running in a serpentine pattern. They’ll be distracted by their portfolios, and their longer legs don’t corner well.

Recognize the behavioral signs of impending aggression.

The men charge or attack only when they feel threatened. If you see their face reddening, or they’re interrupting more than usual, or there’s an increase in their vocal speed or volume, those are warning signs that either you’re about to be left off the invite for the client pitch or your boss is going to confide in you that he and his wife are nothing more than roommates.

When all else fails, fight back.

If the preventative and de-escalating measures above don’t work and you find yourself in a high-conflict encounter with a man in the male-dominated fields, fight to defend yourself. In this unfortunate instance, you’ll have to resort to telling him you had sex with his mother last night. He will usually retreat after this, as men are fiercely protective of their food, their money, and their mothers’ chastity.

Stay together.

There is strength in numbers. As you climb to the top, you may encounter another woman on the same path. The worst thing you can do is throw her to the wolves to save yourself. Travel in packs and pave the way for future women traversing the male-dominated fields. Nature is cruel. You’re better than that.